Table of Content

Many sellers waiting for the market to turn around will likely give in and increase the inventory. This indicates that the rate of existing home sales has slowed to its lowest level in 10 years. We do not recommend listing with a full-service real estate agents in Alabama as they charge hefty commissions. Offer financial incentives like covering all closing costs, accepting all costs ofAlabama property inspections, or providing a transferable home warranty. Redfin’s data tells us how a typical home sells for less than the asking price.

Can sell for about 1% above list price and go pending in around 5 days. But if you think you have to spend big money to see a big return on your investment, think again. Other best cities to live in include the state capital of Little Rock, a historic city set along the Arkansas River, and the quaint city of Bentonville, where Walmart got its start. Home prices have an extensive span, and there are some wildly expensive properties in the United States. Heat risk estimates how much climate change might increase the typical number of hot days in a year and the likelihood of extreme heat and heatwaves.

Just 3 in 100 Pandemic Homebuyers Would Fall Underwater With Next Year’s Projected 4% Home-Value Decline

States with a higher cost of living will likely have higher home prices, but they may also have a higher average income. Home prices are also dependent upon the size of the home, so purchasing a starter home may run you less than the median home price in any given state. The Alabama real estate housing market starts to slow when the properties’ supply exceeds the present demand. When applying for a mortgage, homebuyers with a FICO® Score of 760 or higher typically qualify for the lowest mortgage rates. Although Washington's median income is 20% more than the U.S. median, that's not nearly enough to match its home prices.

The tool automatically checks for updates from the FHFA and Bureau of Labor Statistics once a week. Depending on the data release, it will only be a maximum of one week out of date with those series. That means if reported inflation is ahead of home prices, it will inflation-adjust the front month or two . ClimateCheck™ analyzes a property's risk from climate change using the latest modeling and data from climate scientists, universities, and federal agencies. Yun predicts a balanced market in which neither buyer nor seller has a monopoly.

Huntsville

The supply of newly constructed houses has yet to return to pre-2007 levels. Also, there’s no way that they buy land, get regulatory approval, and increase the supply quickly. Let’s look at why most experts believe that the housing market is not going to crash.

Americans spend more on housing than any other expense, with an average of 35% of income dedicated to housing costs. Homeownership allows households to invest a portion of that money into a tangible asset that appreciates over time. For this reason, 91% of Americans indicate that they would like to own a home in their lifetime. Still, the new market created in the wake of the Coronavirus has forced many real estate investors in Alabama to reevaluate their exit strategies.

How hot is the Birmingham housing market?

Thus, if there is a high demand from buyers in your area, you can benefit from the slow market by selling your home. Furthermore, builders remember the Great Recession well and have been cautious in their construction pace. Hence, there was an ongoing shortage of available homes for sale by 3.2 months’ supply in September 2022. Doesn’t matter if you’re in a hot seller’s market or a slow buyer’s market. Almost 90% of buyers are represented by a buyer agent who shares access to the local MLS. To get the top dollar value for your money, it’s beneficial to focus on the local housing market in Alabama.

Mortgage Interest rates significantly impact the current housing market. These rates have priced many buyers out of the market as they’re at record highs in more than 20 years. Incomes are 22% less than the national median, but the median house price is less than half of the typical U.S. price. Homeowners in Missouri don't need to spend too much of their money on their mortgages. Housing costs are well below the typical U.S. price, and earnings are only 8% less than the national median.

Will real estate house market value continue to fall?

Oregon's homeownership rate, at 64.3%, is slightly lower than the national average. Home sizes are also slightly below average, with a typical unit measuring 1,780 square feet. A typical home in Washington state is 1,903 square feet and costs $595,723. However, despite the high housing costs, Washington State residents enjoy one of the country's best qualities of living.

The median selling price reached $167,427 in October 2022, marking a 2.5% increase compared to the year prior. 25% of homes sold above the asking price, and houses sold on average after 53 days on the market. In finding the average price, all prices of homes listed are added and then divided by the number of homes sold. Homes in Huntsville receive 2 offers on average and sell in around 29 days. The average sale price of a home in Huntsville was $320K last month, up 4.0% since last year.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Putting 20% down means you don't need to pay private mortgage insurance. That doesn't quite pass the 28% rule, which says that your mortgage payment should be no more than 28% of your pre-tax income. Many or all of the products here are from our partners that pay us a commission.

The high demand for houses decreases when there’s a downtrend in the nation’s economy. With less disposable income, more layoffs, and few income opportunities, homebuyers resistbuying a home in Alabama. As the mortgage rate decreases, it gets more convenient for the homebuyer to afford a home. Understanding current government policies can help you predict the demand and supply and identify potentially false real estate market news. The Ascent also has a mortgage calculator that can help you figure out mortgage payments and house affordability calculator to help you determine how much real estate you can afford.

It's a somewhat high figure caused by a median income 15% below the national median. Homes in Connecticut cost less than the typical price across the country while the median income in the state beats the U.S. median by 20%. The typical cost is less than half the typical U.S. price, which makes up for a median income 25% below the norm. That data doesn't give us a full picture of home prices around the United States. There's no state-level data available for it, and it's only sales prices, so it's not the only way to capture home values. That's why we're also including Zillow's information on home prices.

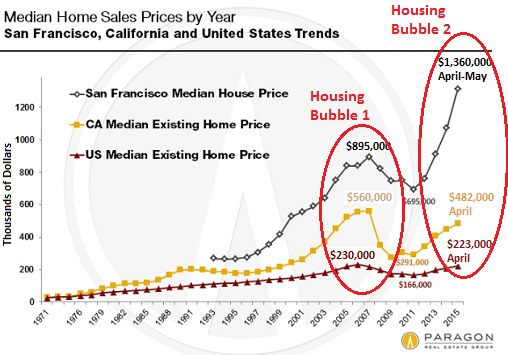

California, New York, and Hawaii are among the states with the highest housing prices and the lowest levels of homeownership. On the other hand, states with relatively low housing costs tend to have higher levels of homeownership. West Virginia, which has the lowest typical-house cost, also has the highest homeownership rate, with 79.6% of residents owning their own home. Increases in the last year are primarily the result of indicators created in the wake of COVID-19.

Homeowners in Rhode Island are often stretched thin by costly mortgage payments. That's because of expensive homes and a median income (18% more than the U.S. median) that isn't enough to balance those out. Despite how costly New York City is, New York as a whole isn't nearly as bad.

In Minnesota, homeowners normally have a little breathing room in their budgets. The typical home price is below the U.S. price, and incomes beat the country as a whole by 16%. The median home sales price is $428,700 as of the first quarter of 2022. Mortgage payments on a typically priced home equal 30.7% of the U.S. median income. The median home price in the U.S. increased by 416% from 1980 to 2020. Members receive 10 FREE city profile downloads a month, unlimited access to our detailed cost of living calculator and analysis, unlimited access to our DataEngine, and more.